Plan for retirement.

Ideally, retirement should be planned as much in advance as possible, because the more time you allow for your savings to grow, the bigger your nest egg will be when it’s time to cash in. Here’s how to get started.

Once your present financial situation is operating more smoothly, it’s time to plan for your financial future, namely your retirement.

Here’s how to get started on your retirement planning.

1. Set a target number.

Before you start putting aside money for the future, determine how much you’ll need to have saved for living comfortably and independently throughout retirement. Experts assume you’ll need 80% of your current annual income each year that you are retired, and that you will be retired for 30 years. You can estimate your retirement needs in a few simple steps by taking your current annual income multiplied by 0.80, and then multiplying that by 30 to reach the amount you’ll need for sustaining yourself.

You’ll find this helpful retirement savings goal calculator in our Planning for Retirement online learning module. You can also use our Retirement Income Calculator and our 401(k) Calculator to help with your planning.

2. Choose your retirement accounts.

There are many options available that may help you save the money you need to meet your retirement savings goals. Here’s a quick review of the two most common retirement accounts:

- 401(k): If you’re currently or previously employed, you may already have a 401(k) that’s collecting money for your retirement and investing it so it can have an opportunity to grow. Leverage this retirement tool by maximizing your contributions and taking advantage of any employer-matched contributions. Many employers will match a portion, or all of, your contributions, which is literally free money that will help your investments grow tax-deferred.

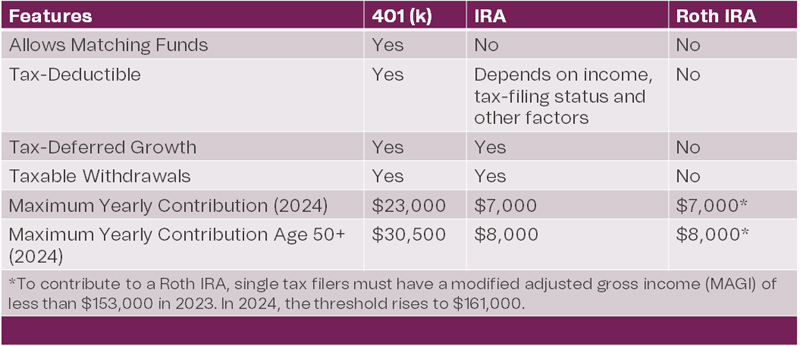

- Individual Retirement Account (IRA): Open and begin regular contributions to an IRA. An Individual Retirement Plan (IRA) is a retirement fund that allows your money to grow tax-deferred. There are federal limits on how much you can add to your IRA annually and income restrictions (see details below). You can choose between a conventional IRA or a Roth IRA. A conventional IRA lets your money grow tax-deferred, but withdrawals are taxable. A Roth IRA does not feature tax-deferred growth, but qualified withdrawals are not taxed.

Learn more about IRAs in our free, online learning module, which covers how an IRA works, its advantages, and what to consider before opening a traditional IRA to hold your retirement funds.

3. Take advantage of catch-up contributions if you are age 50 or older.

As shown in the chart below, people age 50+ can make additional contributions. This is particularly helpful if you haven’t yet put aside the amount needed for a comfortable retirement.

4. Select your investment vehicles.

After you’ve identified the retirement fund strategy that best works for your goals, you’ll also need to choose somewhere to invest the money. You may want to select a target date fund. This refers to your planned retirement date. You’ll know your employer offers a target date fund if there’s a calendar year in the name of the fund, such as “B.K. Holdings Retirement 2055 Fund”. Simply determine an estimated guess of the year you intend to retire, and then pick the fund with the date closest to your anticipated retirement date.

A target date fund is a smart choice because it spreads the money in your 401(k) across many asset classes, such as large company stocks, small-company stocks, bonds, and emerging-markets stocks. Then, as you near the target date, the fund becomes more conservative, owning less stocks and more bonds, automatically reducing your risks as you near the date of your retirement.

With a bit of work and a lot of planning, you’ll have your future secured in the best way possible. As you go along, check in periodically to make sure you’re making the progress you want.

Promotional content related to product page

Learn more strategies for Preparing for Retirement by going through our free online learning module playlist.