Boost your credit score.

Your credit score is a crucial part of your financial health. The three little numbers measure how likely you are to repay borrowed money.

The most commonly used credit score model, FICO, has a range of 300 to 850. An excellent credit score (800+) can open the door to large loans with better interest rates, as well as employment opportunities and more. On the flip side, a poor credit score (less than 580) can be a strong impediment toward building wealth, funding large purchases, and finding gainful employment.

Let’s explore the best ways to boost your credit score.

1. Pay all your bills on time.

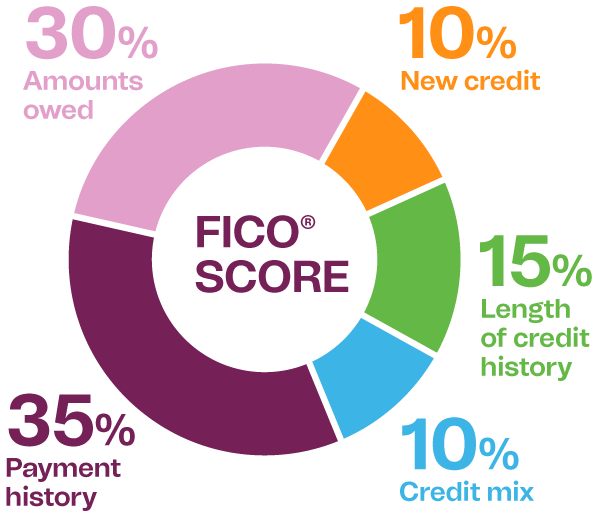

Paying your bills when, or before, they’re due is a major factor in determining your overall credit score, accounting for up to 35%. If you pay your bills on time, it shows you can be counted on to repay your loans responsibly. To avoid late payments, you can set up automatic monthly payments for your bills. Just make sure you keep the account you are paying from well-funded to cover your payments as they come out.

2. Keep your credit utilization below 30%.

Another crucial factor contributing to your score is your credit utilization ratio. This refers to the amount of available credit you have and use. It’s best to keep your utilization under 30%, or even 10% if you can. To that end, make sure you’re using just a bit of your available credit each month. In addition, consider accepting offers for increased credit – as long as you know you won’t rack up huge bills by having all that additional credit.

3. Maximize your credit card payments.

Review your monthly budget to find a way you can trim your expenses, or look for a side hustle, and use the extra cash to maximize your payments toward your debt. You can pay down debt by using one of the debt-crushing methods. Keep at it until you’re debt-free. It may take a while to crush a mountain of debt, but showing the credit bureaus that you’re on track to pay off that debt can do wonders for your score.

4. Keep your credit cards open and active.

Many consumers mistakenly believe the path toward great credit is through swearing off all credit cards. However, building and preserving a healthy credit score requires owning a card or two and keeping them active. If you’re just starting out, consider signing up for a beginner’s card, which generally features easy eligibility requirements and very little available credit. Otherwise, be sure you have a minimum of three open cards and that you use them on a regular basis.

Tip! To keep your cards active without having an open balance, you can pay one fixed monthly bill, such as a subscription or monthly membership fee, with each of your credit cards. Set up an automatic monthly payment for the bill by linking your credit card, and then set up an automatic monthly payment for the credit card, too, by linking your checking account to the card. Choose to have the money transferred before the bill is actually due. This way, your cards will be open and active, and you’ll never have a late payment, which would negatively impact your credit score. Several months of using your cards responsibly will generally help move your credit score upward.

However, don’t open multiple new credit cards all at once. New accounts or new credit lowers the average age of your existing accounts, which can negatively impact your score (10%). Also, opening multiple accounts in a short period of time is considered “a risk” by reporting agencies.

Other factors that affect your credit score include the length of credit history (15%) and the types of accounts you have (10%). In general, a longer credit history will increase your credit score, because creditors can see if you’ve been making payments responsibly. Also, showing that you can successfully manage a mix of credit accounts – e.g., credit cards, retail accounts, installment loans, and mortgage loans – impacts your score, too.

Learn more about the factors that can influence your credit score using our Credit Basics resource.

5. Review your credit reports and your monthly statements.

Check each of your three credit reports once a year to make sure your information is accurate, and no accounts have been opened in your name without your knowledge. You can get a free copy of your credit report from each credit bureau once a year by visiting annualcreditreport.com. Your credit report is a record of your credit activity and current credit situation, such as loan repayment history and the status of your credit accounts.

Lenders, insurers, employers, and others can obtain your credit report from a credit bureau or consumer reporting agency to determine whether you are a good candidate. So, it is key to your financial wellness.

Managing your credit card and debt responsibly goes a long way toward positively impacting your overall finances, so be sure to make it a priority on your financial wellness journey.

Promotional content related to product page

Visit our free online learning module about Credit Scores and Reports to learn more about how credit is measured and the impact it can have on your financial goals.