Pay yourself first.

Thus far on our Financial Wellness Journey, we’ve covered how to track your spending, design a monthly budget, and create a plan for paying down your existing debt. In this step, you’ll learn how to successfully pay yourself first.

“Pay yourself first” is a catchphrase that means prioritizing your personal savings above other expenses. Savings should not be an afterthought or an extra that only happens if there’s money left over at the end of the month. Putting aside money should be a fixed line on your budget that happens every month without fail.

Here’s how to successfully pay yourself first.

1. Review your budget.

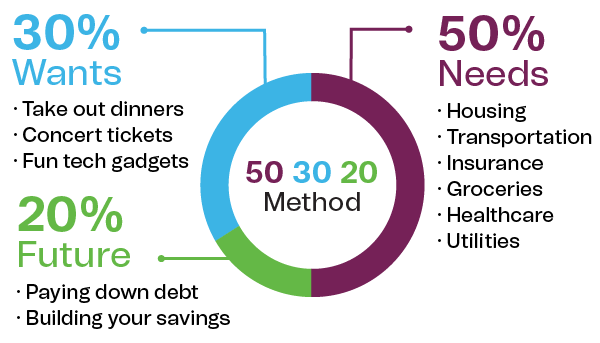

Take a look at your spending. A good model you can use is the 50/30/20 budget—spending roughly 50 percent of your after-tax dollars on necessities, no more than 30 percent on "wants," and at least 20 percent into building your savings or paying off debts. Refer back to step 1 of the financial wellness journey to learn more about building a monthly budget.

2. Set short- and long-term saving goals.

It is important to build up your savings to cover emergencies and to plan for your future. Short-term savings, or funds you want to be able to access in the near future, can be allocated to an emergency fund. Experts advise having three to six months’ worth of living expenses set aside in an emergency fund in case of a sudden, large expense and/or loss of employment. Some people also build a rainy-day fund, or a slush fund that can be used to pay for anything at all, such as a spontaneous vacation or a large discretionary purchase like a new phone.

Long-term savings should include funds you can afford not to touch for several years or more. Your long-term saving goals can include funding your retirement, as well as a down payment on a home, a new car, a sabbatical from work, or any other super-big expense.

Narrow down your short- and long-term goals until you have a realistic picture, then attach a number to each savings category.

3. Set a timeline for each savings goal.

Now that you have a number for the amount of funds you want to save, you’ll need to determine a realistic timeline for meeting those goals. You’ll want to give first priority to your emergency fund, but at the same time it’s best not to neglect your future and to start saving for retirement today. This allows time to let compound interest work its magic.

To that end, you may want to allocate the bulk of your monthly savings to your emergency fund until you meet your goal. Once your emergency fund is full, you can divide your savings more evenly between your short-term savings and long-term savings.

While you work through this step, you may want to reach out to a human resources representative at your workplace and/or your accountant to discuss your options for a 401(k), individual retirement account (IRA), or another retirement plan.

4. Calculate how much you’ll need to save each month.

You’re ready to determine how much money you’ll need to put into savings each month to reach your goals by their deadlines. Take your total for each goal and divide it by the number of months in your timeline. For example, if you’ve decided you want to have an emergency fund of $24,000 set up in four years’ time, you’ll divide $24,000 by 48 months to get $500 a month. This is the amount you’ll need to set aside each month to reach your goal in time. Do this for each of your goals.

As you work through this step, don’t forget to account for any interest you’ll accrue for your long-term savings. Also, remember to prioritize your short-term savings for emergencies and adjust your savings allocation once your emergency fund is set up. Without the funds to get you through an emergency, your savings can be depleted as soon as any unexpected expense crops up.

5. Automate your savings.

Once you have your savings plan ready to go, it’s best to automate the deposits in your Everwise Savings Accounts, so you don’t have to remember them every payday. You can establish a separate savings account for each of your savings’ goals and give them nicknames that represent your financial targets (like emergency, insurance, or vacation), making it easy to see when you’re closing in on your goals.

Then, set up automatic transfers from your checking account to each savings account, contributing a certain amount each pay period to stay on track. This way, your savings will grow even when you forget to feed them. Think of this money like taxes – it’s not actually part of your take-home pay, because it gets skimmed off the top before it even hits your wallet. But unlike taxes, all of this money (and the dividends or interest it earns) is yours to use when the time is right!

Learn more strategies for automating your savings using our Savings Basics resource.

6. Monitor and tweak as necessary.

Life is dynamic, and your savings plan should be, too. If you find the system you’ve set in place is not working anymore, you can always tweak it and come up with one that better suits your lifestyle. If you find that you’re short on the funds you need to pay yourself first, review your budget again and consider trimming your discretionary spending or freelancing for extra cash before lowering your monthly savings goal. As you go along, check in periodically to make sure you’re making the progress you want.

Congrats–you’ve mastered the art of paying yourself first!

Promotional content related to product page

Learn more strategies with our free online learning module about savings accounts to help you meet your savings goals.