Cybersecurity tips for older adults.

The digital age has transformed how we connect, communicate, and go about daily life. With the advent of online shopping, social media, and the ability to manage finances with just a few clicks, technology has brought remarkable convenience and efficiency to our lives. However, this technological ease also carries risks, as the same tools that empower us can leave us vulnerable to cyber threats.

Older adults are often among the most targeted by scams and fraudulent schemes, making them particularly at risk. In this article, we’ll share practical, easy-to-follow steps to help you stay protected in an increasingly digital world.

Older adults are often among the most targeted by scams and fraudulent schemes, making them particularly at risk. In this article, we’ll share practical, easy-to-follow steps to help you stay protected in an increasingly digital world.

What is elder fraud?

Elder fraud refers to scams specifically designed to exploit older individuals, often by manipulating their trust and financial security. These deceptive practices can range from identity theft to fake sweepstakes, leaving victims not only financially compromised, but also emotionally distressed. Recognizing and addressing elder fraud is essential to safeguarding the well-being of seniors and ensuring their hard-earned savings remain protected.

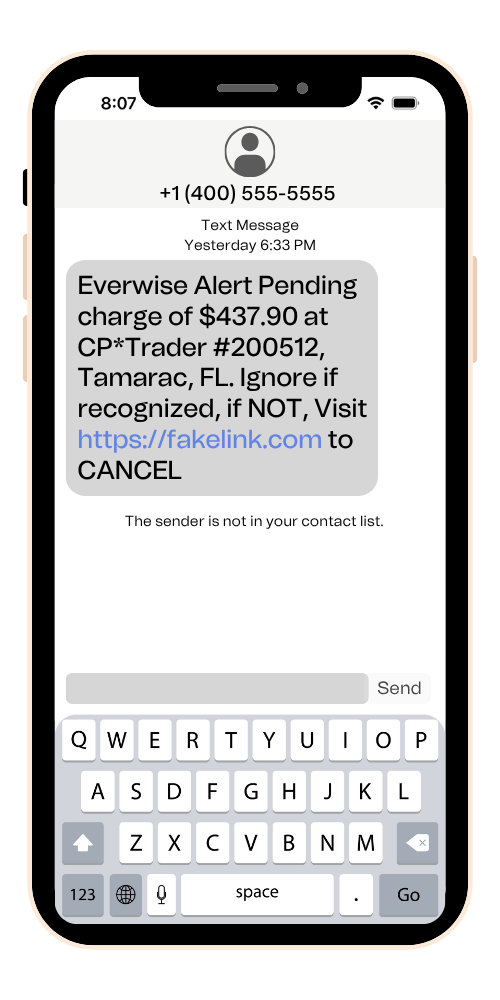

Example of a spoofed text message from a scammer pretending to be Everwise.

Why do scammers target older adults?

Research from the FBI shows that people over 60 are a prime target for online scams, often losing the most money from scams. In a single year, this group reported nearly $5 billion in losses, and the real number is likely much higher. It's not that older adults are more gullible; it's that scammers use specific tactics designed to exploit common traits and circumstances.According to the National Cybersecurity Alliance, scammers often target older adults for a variety of reasons, exploiting specific vulnerabilities that can make them more susceptible to fraud. Here are the key reasons:

- Trusting nature. Many older individuals grew up in an era where trust in others and social etiquette were emphasized, which scammers can manipulate.

- Access to financial resources. Older adults are more likely to have accumulated savings, retirement funds, and assets, making them attractive targets for financial scams. A recent article from the Federal Trade Commission highlights a troubling rise in scams specifically targeting retirees and their life savings.

- Isolation empowers scammers. Social isolation increases vulnerability, as victims may lack someone to share concerns with, and scammers often discourage communication to maintain control.

- Limited familiarity with technology. Technology evolves rapidly, and scammers are quick to exploit it, leveraging advanced tools and tactics to deceive even the most tech-savvy individuals.

- Cybercrimes are invisible by nature. Unlike traditional crimes, cyberattacks often leave no immediate trace, making malicious activity like malware or spyware difficult to detect until significant damage is done.

How can I protect myself against scammers and cybercriminals?

Fortunately, there are lots of preventative measures you can take to protect your information and your money from cyberattacks:- Stay informed about the latest scams and fraud schemes. Knowledge is your first line of defense. By reading this article, you’re already taking an important step! Make it a habit to stay updated by visiting trusted resources, like the National Council on Aging (NCOA). This organization recently shared an article highlighting the top five financial scams targeting older adults.

- Be cautious with emails or text messages from unknown senders. Avoid opening attachments or clicking on links that could contain hidden malware designed to exploit your device.

- Avoid transferring money to "keep it safe." Under no circumstances should you send money to someone based on an unexpected call, email, or message, regardless of their claims or urgency. Even if they insist it's to "protect your funds," remain cautious and reach out to Everwise directly for assistance.

- Keep your software updated. Regular updates deliver essential security patches, ensuring your devices remain protected from emerging threats.

- Use strong, unique passwords. A password length of 16 or more characters is best. Be sure to vary your use of capitalization, symbols, letters, and numbers. For optimal security, switch up your password every six months.

- Enable multifactor authentication (MFA). Whenever possible, use MFA to add another layer of protection, requiring more than one form of verification to access your accounts.

- Use anti-virus software. Reliable anti-virus tools actively detect and remove threats, helping to protect your devices in real-time.

What should I do if I’ve been targeted by a spoofing attack?

- Remember, we will never call, email, or text to ask for your Everwise account or card information, secure access code, online banking username/password, or other account IDs, such as your Apple or Google ID.

- Always double-check the web address, email address, and phone number of any communication you receive using the company’s legitimate website. If there are errors or it seems like the message is trying to create a sudden sense of urgency, it is likely a scam.

- Do not respond to or click on any links in suspicious communications. Delete any text messages or emails from the scammer, and do not answer their phone calls.

- When in doubt, reach out. Call our Member Services team at (800) 552-4745 to report the incident.

More on Fraud Prevention

Cybersecurity 101

How to Protect Yourself From Fraud

Beware of AI Scams

Steps to Report Fraud

Staying connected online is a wonderful way to keep in touch with family, manage finances, and explore new hobbies. However, it's also important to be aware of online risks. With these smart habits, you can protect your money and personal information with confidence.

Promotional content related to product page

We take fraud very seriously. Everwise will NEVER call or text you to ask for your account information, secure access code, card information, or online username/password.

Disclosure

All information presented on this page is for educational purposes only and doesn’t constitute tax, legal, or accounting advice. It is to be considered as general information, not recommendations. Please consult with an attorney or tax professional for guidance.