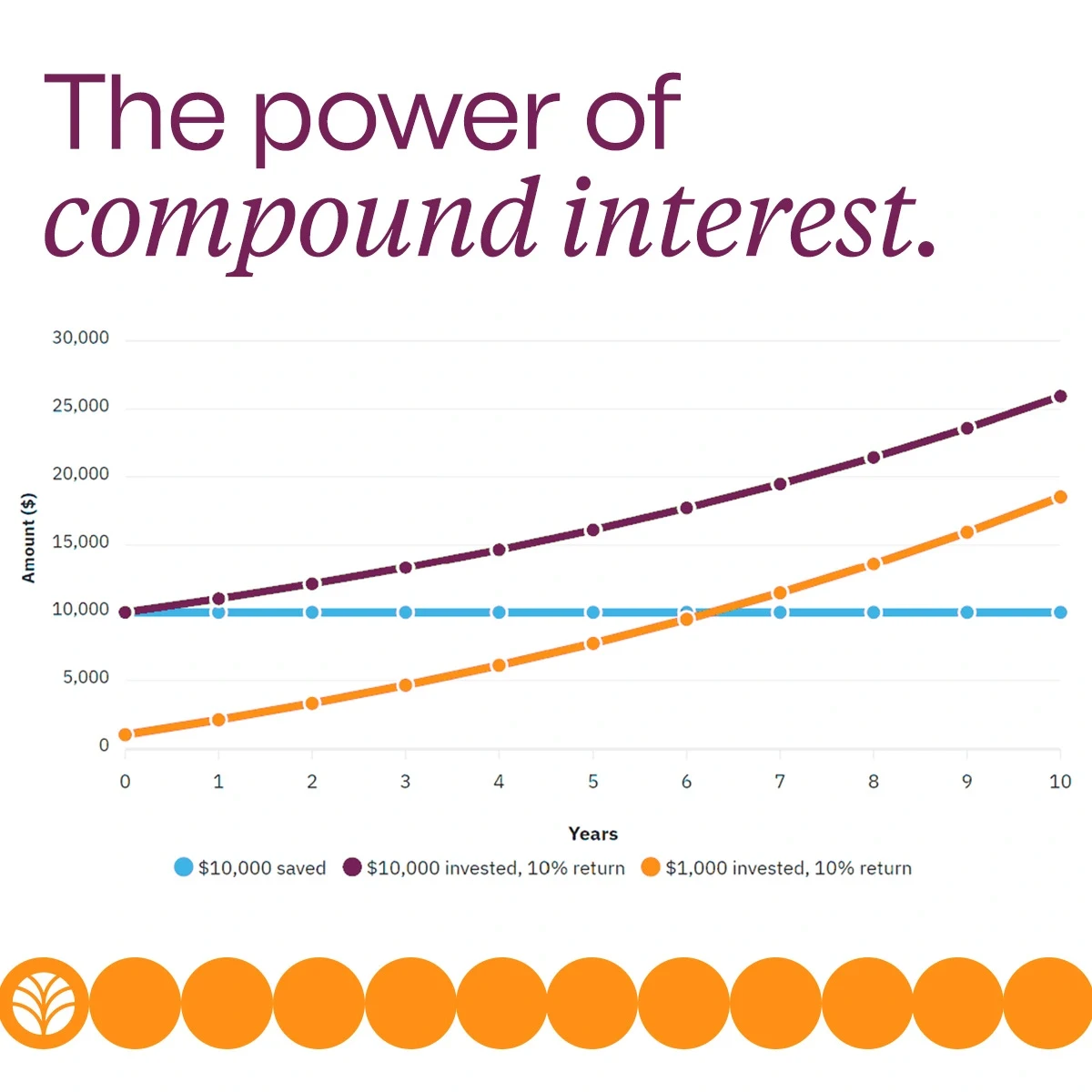

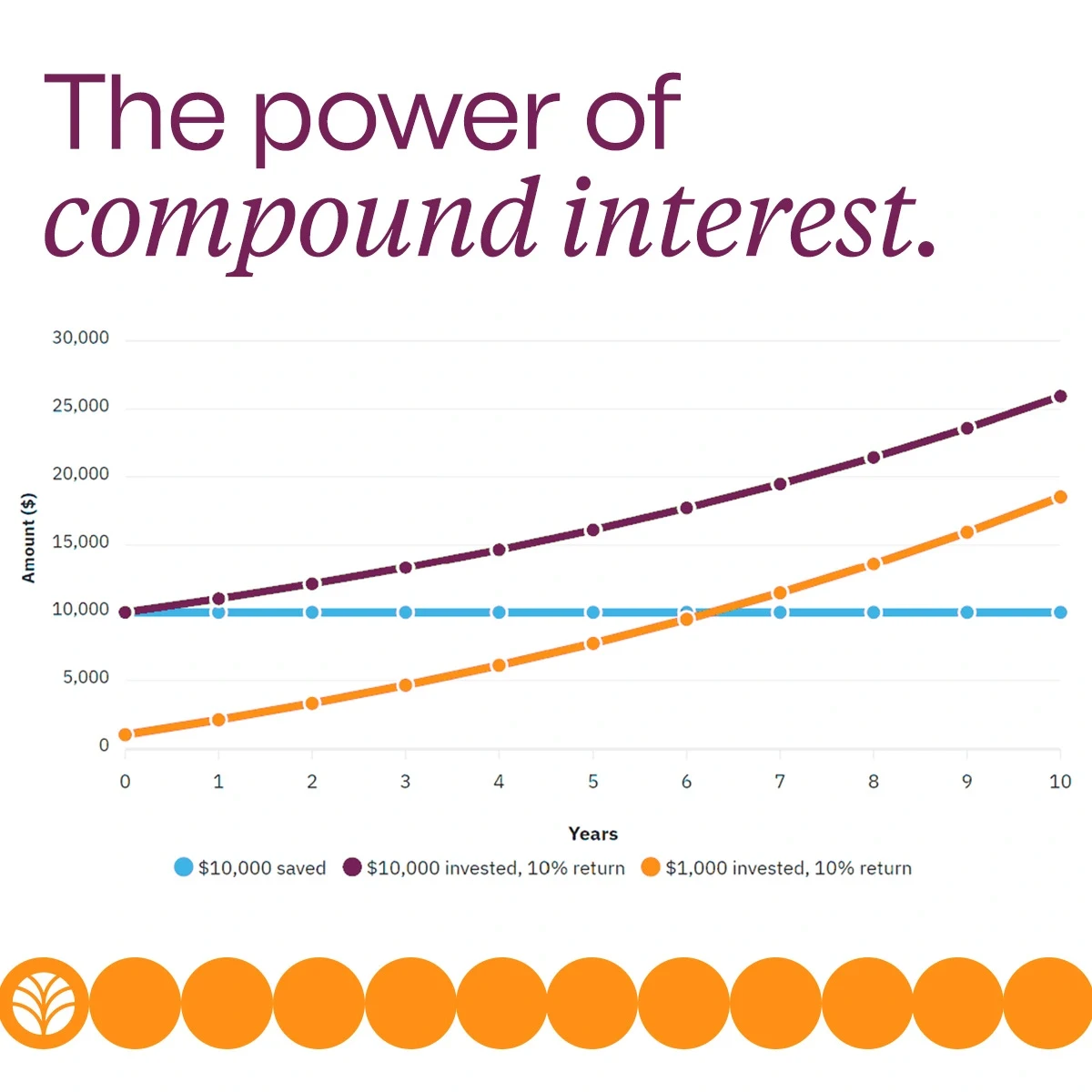

Compound interest is the interest you earn on both your initial investment (the principal) and the accumulated interest from previous periods. In simple terms, your money starts making its own money. This process allows your wealth to grow at an accelerating rate over time. For example, if you invest $1,000 at a 5% annual compound interest rate, you earn $50 in the first year. The next year, you earn 5% on $1,050, and so on, causing your investment to grow faster each year.

Understanding compound interest is crucial for building long-term wealth, whether for retirement, savings goals, or achieving financial freedom. The earlier you start investing, the more time your money has to grow.

How does compound interest make you money?

Compound interest makes you money by reinvesting the interest you earn. Instead of paying the interest out, it's added back to your principal amount. This new, larger principal then earns interest in the next period.

Let's look at an example:

- Simple Interest: You invest $1,000 at a 5% simple annual interest rate. You would earn $50 every year. After 10 years, your total would be $1,500.

- Compound Interest: You invest the same $1,000 at a 5% annual compound interest rate. After 10 years, your investment would grow to $1,628.89. The extra $128.89 is the money your interest earned.

The key factors that influence how much you can earn are:

- The principal amount: The initial amount you invest.

- The interest rate: The higher the rate, the faster your money grows.

- The compounding frequency: Interest can be compounded daily, monthly, or annually. More frequent compounding means faster growth.

- Time: The longer you let your money grow, the more significant the effect of compounding becomes.

Why is it important to start investing early?

Time is the most powerful ingredient for compound interest. The earlier you begin investing, the more time your money has to work for you, leading to exponential growth.

Consider this scenario with a 7% annual return:

- Start at age 25: If you invest $200 per month, you could have nearly $480,000 by age 65.

- Start at age 35: If you start the same plan just 10 years later, you would only have about $227,000 by age 65.

That 10-year delay can cost you more than half of your potential returns. Starting early, even with small amounts, can make a huge difference in your financial future.

What is the Rule of 72?

The Rule of 72 is a simple formula to quickly estimate how long it will take for an investment to double in value. To use it, you just divide 72 by your annual interest rate.

Formula: 72 / Interest Rate = Years to Double

For instance, if your investment has an annual return of 6%, it will take approximately 12 years to double (72 / 6 = 12). This handy trick can help you visualize the long-term growth potential of your investments and motivate you to save.

How can compound interest work against you?

While compound interest is great for savings, it can be destructive when it comes to debt. High-interest debt, like credit card balances, also compounds. This means you are charged interest on your original debt plus the accumulated interest.

If you carry a balance on your credit card, the interest compounds quickly, making it much harder to pay off the debt. This is why it’s so important to pay off high-interest loans as quickly as possible.

How can I make compound interest work for me?

Even if you're getting a late start, you can still take advantage of compound interest. Here are four steps you can take today:

- Open a high-yield savings or investment account. Look for accounts that offer competitive interest or dividend rates. At Everwise, our Boost High-Yield Savings account is designed to help your money grow faster.

- Use employer retirement plans. If your employer offers a 401(k) or similar retirement plan with a company match, contribute at least enough to get the full match. It’s an instant, guaranteed return on your investment.

- Automate your contributions. Set up automatic transfers from your checking account to your savings or investment accounts. This "pay yourself first" strategy ensures you are consistently building your wealth.

- Educate yourself and stay consistent. The more you learn, the more confident you'll become. Use financial calculators and resources to track your progress and stay motivated.

Your money should work just as hard as you do. By harnessing the power of compound interest, you can build a more secure financial future.

Ready to put your money to work? Everwise offers a variety of high-yield savings options to help you start your journey.