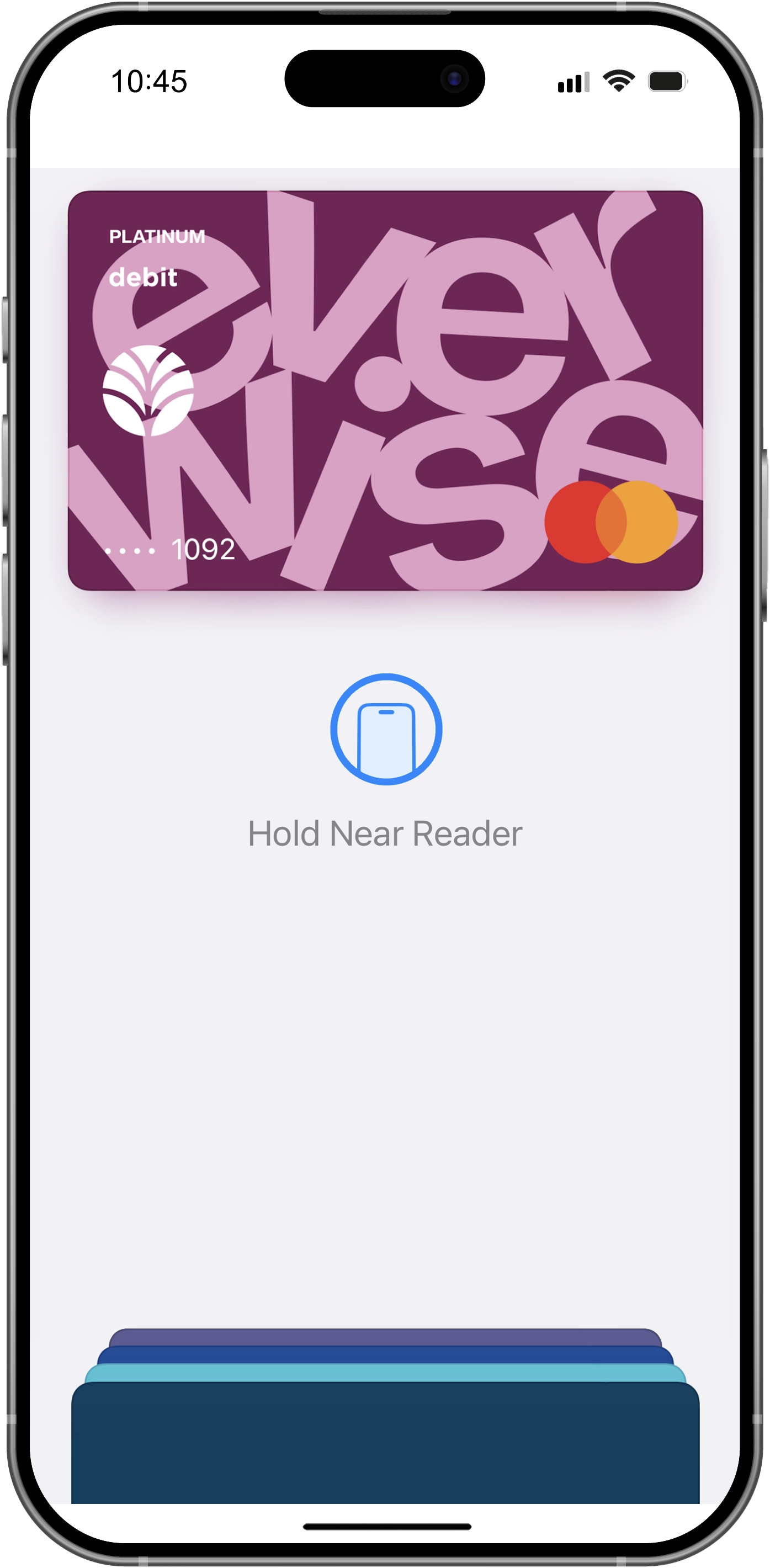

Message & data rates may apply, please contact your provider for more information. Apple, the Apple logo, and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries. Apple Pay is a trademark of Apple Inc; Google Pay is a trademark of Google Inc; Samsung Pay is a trademark of Samsung Electronics Co., LTD.

Subject to membership eligibility requirements. Loans subject to credit approval. Borrower must be a resident of Indiana or Michigan, and for home loans property must be in Indiana or Michigan. All credit union programs, rates, terms, and conditions may change without notice.